About the Great Depression

The Great Depression was an economic slump in North America, Europe, and other industrialized areas of the world that began in 1929 and lasted until about 1939. It was the longest and most severe depression ever experienced by the industrialized Western world.

Though the U.S. economy had gone into depression six months earlier, the Great Depression may be said to have begun with a catastrophic collapse of stock-market prices on the New York Stock Exchange in October 1929. During the next three years stock prices in the United States continued to fall, until by late 1932 they had dropped to only about 20 percent of their value in 1929. Besides ruining many thousands of individual investors, this precipitous decline in the value of assets greatly strained banks and other financial institutions, particularly those holding stocks in their portfolios. Many banks were consequently forced into insolvency; by 1933, 11,000 of the United States' 25,000 banks had failed. The failure of so many banks, combined with a general and nationwide loss of confidence in the economy, led to much-reduced levels of spending and demand and hence of production, thus aggravating the downward spiral. The result was drastically falling output and drastically rising unemployment; by 1932, U.S. manufacturing output had fallen to 54 percent of its 1929 level, and unemployment had risen to between 12 and 15 million workers, or 25-30 percent of the work force.

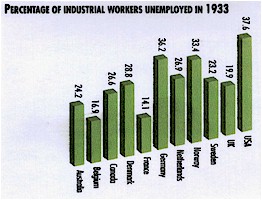

The Great Depression began in the United States but quickly turned into a worldwide economic slump owing to the special and intimate relationships that had been forged between the United States and European economies after World War I. The United States had emerged from the war as the major creditor and financier of postwar Europe, whose national economies had been greatly weakened by the war itself, by war debts, and, in the case of Germany and other defeated nations, by the need to pay war reparations. So once the American economy slumped and the flow of American investment credits to Europe dried up, prosperity tended to collapse there as well. The Depression hit hardest those nations that were most deeply indebted to the United States, i.e., Germany and Great Britain. In Germany, unemployment rose sharply beginning in late 1929, and by early 1932 it had reached 6 million workers, or 25 percent of the work force. Britain was less severely affected, but its industrial and export sectors remained seriously depressed until World War II. Many other countries had been affected by the slump by 1931.

Almost all nations sought to protect their domestic production by imposing tariffs, raising existing ones, and setting quotas on foreign imports. The effect of these restrictive measures was to greatly reduce the volume of international trade: by 1932 the total value of world trade had fallen by more than half as country after country took measures against the importation of foreign goods.

The Great Depression had important consequences in the political sphere. In the United States, economic distress led to the election of the Democrat Franklin D. Roosevelt to the presidency in late 1932. Roosevelt introduced a number of major changes in the structure of the American economy, using increased government regulation and massive public-works projects to promote a recovery. But despite this active intervention, mass unemployment and economic stagnation continued, though on a somewhat reduced scale, with about 15 percent of the work force still unemployed in 1939 at the outbreak of World War II. After that, unemployment dropped rapidly as American factories were flooded with orders from overseas for armaments and munitions. The depression ended completely soon after the United States' entry into World War II in 1941. In Europe, the Great Depression strengthened extremist forces and lowered the prestige of liberal democracy. In Germany, economic distress directly contributed to Adolf Hitler's rise to power in 1933. The Nazis' public-works projects and their rapid expansion of munitions production ended the Depression there by 1936.

At least in part, the Great Depression was caused by underlying weaknesses and imbalances within the U.S. economy that had been obscured by the boom psychology and speculative euphoria of the 1920s. The Depression exposed those weaknesses, as it did the inability of the nation's political and financial institutions to cope with the vicious downward economic cycle that had set in by 1930. Prior to the Great Depression, governments traditionally took little or no action in times of business downturn, relying instead on impersonal market forces to achieve the necessary economic correction. But market forces alone proved unable to achieve the desired recovery in the early years of the Great Depression, and this painful discovery eventually inspired some fundamental changes in the United States' economic structure. After the Great Depression, government action, whether in the form of taxation, industrial regulation, public works, social insurance, social-welfare services, or deficit spending, came to assume a principal role in ensuring economic stability in most industrial nations with market economies.

The International Depression

The Great Depression of 1929-33

was the most severe economic crisis of modern times. Millions of people lost

their jobs, and many farmers and businesses were bankrupted. Industrialized

nations and those supplying primary products (food and raw materials) were all

affected in one way or another. In Germany the United States industrial output

fell by about 50 per cent, and between 25 and 33 per cent of the industrial

labour force was unemployed.

The Great Depression of 1929-33

was the most severe economic crisis of modern times. Millions of people lost

their jobs, and many farmers and businesses were bankrupted. Industrialized

nations and those supplying primary products (food and raw materials) were all

affected in one way or another. In Germany the United States industrial output

fell by about 50 per cent, and between 25 and 33 per cent of the industrial

labour force was unemployed.

The Depression was eventually to cause a complete turn-around in economic theory and government policy. In the 1920s governments and business people largely believed, as they had since the 19th century, that prosperity resulted from the least possible government intervention in the domestic economy, from open international relations with little trade discrimination, and from currencies that were fixed in value and readily convertible. Few people would continue to believe this in the 1930s.

THE MAIN AREAS OF DEPRESSION

The US economy had experienced rapid economic growth and financial excess in the late 1920s, and initially the economic downturn was seen as simply part of the boom-bust-boom cycle. Unexpectedly, however, output continued to fall for three and a half years, by which time half of the population was in desperate circumstances (map1). It also became clear that there had been serious over-production in agriculture, leading to falling prices and a rising debt among farmers. At the same time there was a major banking crisis, including the "Wall Street Crash" in October 1929. The situation was aggravated by serious policy mistakes of the Federal Reserve Board, which led to a fall in money supply and further contraction of the economy.

|

|

The economic situation in Germany (map2) was made worse by the enormous debt with which the country had been burdened following the First World War. It had been forced to borrow heavily in order to pay "reparations" to the victorious European powers, as demanded by the Treat of Versailles (1919), and also to pay for industrial reconstruction. When the American economy fell into depression, US banks recalled their loans, causing the German banking system to collapse.

|

|

Countries that were dependent on the export of primary products, such as those in Latin America, were already suffering a depression in the late l920s. More efficient farming methods and technological changes meant that the supply of agricultural products was rising faster than demand, and prices were falling as a consequence. Initially, the governments of the producer countries stockpiled their products. but this depended on loans from the USA and Europe. When these were recalled, the stockpiles were released onto the market, causing prices to collapse and the income of the primary-producing countries to fall drastically (map3).

|

|

NEW INTERVENTIONIST POLICIES

The Depression spread rapidly around the world because the responses made by governments were flawed. When faced with falling export earnings they overreacted and severely increased tariffs on imports, thus further reducing trade. Moreover, since deflation was the only policy supported by economic theory at the time, the initial response of every government was to cut their spending. As a result consumer demand fell even further. Deflationary policies were critically linked to exchange rates. Under the Gold Standard, which linked currencies to the value of gold, governments were committed to maintaining fixed exchange rates. However, during the Depression they were forced to keep interest rates high to persuade banks to buy and hold their currency. Since prices were falling, interest-rate repayments rose in real terms, making it too expensive for both businesses and individuals to borrow.

The First World War had led to such political mistrust that international action to halt the Depression was impossible to achieve In 1931 banks in the United States started to withdraw funds from Europe, leading to the selling of European currencies and the collapse of many European banks. At this point governments either introduced exchange control (as in Germany) or devalued the currency (as in Britain) to stop further runs. As a consequence of this action the gold standard collapsed (map 4).

|

The gold standard linked currencies

to the value of gold, |

POLITICAL IMPLICATIONS

The Depression had profound political implications. In countries such as Germany and Japan, reaction to the Depression brought about the rise to power of militarist governments who adopted the regressive foreign policies that led to the Second World War. In countries such as the United States and Britain, government intervention ultimately resulted in the creation of welfare systems and the managed economies of the period following the Second World War.

In the United States Roosevelt became President in 1933 and promised a "New Deal" under which the government would intervene to reduce unemployment by work-creation schemes such as street cleaning and the painting of post offices. Both agriculture and industry were supported by policies (which turned out to be mistaken) to restrict output and increase prices. The most durable legacy of the New Deal was the great public works projects such as the Hoover Dam and the introduction by the Tennessee Valley Authority of flood control, electric power, fertilizer, and even education to a depressed agricultural region in the south.

The New Deal was not, in the main, an early example of economic management, and it did not lead to rapid recovery. Income per capita was no higher in 1939 than in 1929, although the government’s welfare and public works policies did benefit many of the most needy people. The big growth in the US economy was, in fact, due to rearmament.

In Germany Hitler adopted policies that were more interventionist, developing a massive work-creation scheme that had largely eradicated unemployment by 1936. In the same year rearmament, paid for by government borrowing, started in earnest. In order to keep down inflation, consumption was restricted by rationing and trade controls. By 1939 the Germans’ Gross National Product was 51 per cent higher than in 1929 — an increase due mainly to the manufacture of armaments and machinery.

THE COLLAPSE OF WORLD TRADE

The German case is an extreme example of what happened virtually everywhere in the 1930s. The international economy broke up into trading blocs determined by political allegiances and the currency in which they traded. Trade between the blocs was limited, with world trade in 1939 still below its 1929 level. Although the global economy did eventually recover from the Depression, it was at considerable cost to international economic relations and to political stability.

Return to The Great Depression